Secure Real-time Payment Solutions

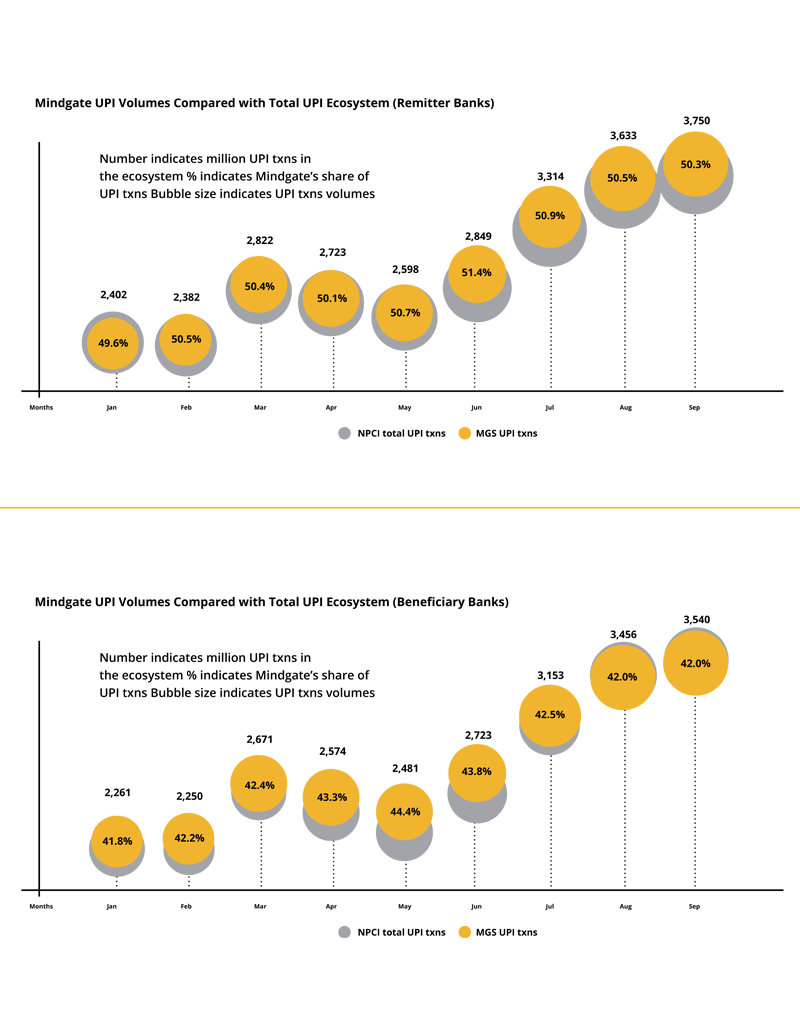

Globally there is an uptick in the launch of the Real-Time Payment System, which is rapidly changing the way consumers transact using new-age digital channels. Mindgate Solution is a pioneer in the RTP & UPI space since its inception, processing 100 million transactions per day and over 2 billion transactions monthly seamlessly and securely.

The platform is built on a state of art technology framework and is optimized for high availability, scalability and facilitates launching various value-added services for all participants across channels with a quick turnaround time and with reduced TCO.

Key Highlights of the Solution

- Platform up to date with all value added services UPI business case.

- No hassle of high-frequency change management (regulatory)

- Auto Scale-Up feature of Microservices Container Platform

- Enabling DevOps and CI-CD helps in Auto Deployment and Rollback

- Customized API creation for Merchant / Corporate

- Microservices based business services ensure agile Change Management

Connect with Our Payment Experts

Key Capabilities

Single Mobile App for customers

- Complete Dashboard to view balances.

- Seamlessly transact across bank accounts.

- Pay using VPA, QR Code, Account Transfer, Digital ID, or Mobile Number.

- Request payments using Collect Transactions.

- Dispute, Refund & Chargeback management.

Small & Medium Merchants

- Standalone Merchant App (BQR based pay & collect, MVISA, MasterPass)

- Web POS, Face-to-Face, POS.

- Merchant Reconciliation Settlements and Pay-outs.

- Dispute, Refund & Chargeback management.

Large Merchants, Aggregators & Prepaid Wallets

- Real-time collection request generation through web API’s/Mobile API’s/ Face to Face Payments.

- Bank Mobile SDK bundled with Merchant App [Retail Chains].

- Recurring and One-time Bulk collections (file Based) through bank channels [EMI collections, utility payments].

- API Banking: Web APIs and SDK [Very Large merchants, Aggregators, Wallet Operators].

- Merchant Reconciliation, Settlements and Pay-outs.

- Dispute, Refund & Chargeback management.

FAQs

Real-time payments are electronic payment settlements that happen instantly, 24/7. Funds are get transferred from the sender’s account to the recipient’s account in seconds, unlike traditional bank transfers that can take several days.

Real-time payments transfer funds instantly between accounts 24/4 using dedicated networks and technology, bypassing the intermediate savings houses and the money goes directly into bank accounts unlike traditional methods which happens with batch processing.

The payers bank instantly initiates payment request to the recipient’s bank account instantly through instant/ real-time payment systems.

- Speed & Convenience: send or receive funds immediately, eliminating waiting period for funds to settle.

- Enhanced cash flow management: Access funds instantly, improving business efficiency.

- Improved customer experience: Fast and convenient payment option is provided, boosting customer satisfaction & loyalty.

- Wider reach: Send & receive payments across borders quickly and efficiently.

- Settlement speed: Real-time payments are instant, while traditional transfers can take days.

- Network: Real-time payments use dedicated networks, while traditional transfers rely on banking systems.

- Cost: Real-time payments might have higher fees compared to some traditional transfers.

- Multi-party model: Real-time payments offer the facility of leveraging payment processing from banks/ fintech/ PSPs enabling open banking.

Businesses can integrate real-time payments through APIs provided by either banks or payment service providers. This enables seamless integration into existing systems for easy adoption.

In India, there are no charges to Individual customers who are transacting on real-time payments (UPI). For merchants there are no charges for transactions up to INR 2,000/-. With the introduction of Credit Card on UPI and more recently with UPI payments made from wallet (PPI), merchants are charged an MDR for transactions above INR 2,000/- These charges are expected to change from time to time.

APIs (Application Programming Interfaces) act as connectors between business systems and the real-time payment network, enabling smooth integration and automation of payment processes.

The UPI switch is the core routing engine that powers Unified Payments Interface transactions. It handles communication between banks, UPI apps, and NPCI’s central system.

It checks and validates account details, routes requests between participants, applies security checks, and provides instant confirmation to the payer and payee — all in a fraction of a second.

- Handles very high transaction volumes.

- Enables 24×7 instant processing.

- Offers built-in fraud and compliance checks.

- Ensures seamless bank-to-bank transfers.

UPI was introduced by the National Payments Corporation of India (NPCI) in 2016. Technology providers like Mindgate support banks with UPI switch solutions.

As of 2025, the general limit is ₹1 lakh per transaction, though specific categories like IPOs and insurance allow payments up to ₹10 lakhs.

It is built on API-first design, featuring authentication modules, risk engines, clearing services, and settlement layers, all running in real time, leveraging open source technology platforms.